Large, easy and convenient online calculator

Use for work, school or personal calculations. You can make not only simple math calculations and calculation of interest on the loan and bank lending rates, the calculation of the cost of works and utilities.

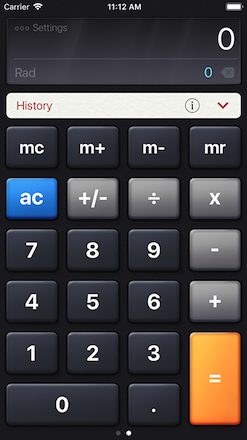

Online Calculator. Everybody needs a Calculator at some point - Full Screen, Fast Loading and FREE! Online Calculator! From the Simple Calculator below, to the Scientific or BMI Calculator. 'Online Calculator' always available when you need it. More calculators will be added soon - as well as many new great features. Paycheck Calculators. You’ve relied on since 1999. Use PaycheckCity's free paycheck calculators, withholding calculators, gross-up and bonus calculators, 401k savings and retirement calculator, and other specialty payroll calculators for all your paycheck and payroll needs.

Commands for the online calculator you can enter not only the mouse, but with a digital computer keyboard. Detailed instructions for using the calculator, see below.

Scientific Calculator. Web2.0calc.com online calculator provides basic and advanced mathematical functions useful for school or college. You can operate the calculator directly from your keyboard, as well as using the buttons with your mouse.

Instructions for using the online calculator

Keys function

[ 0 ], [ 1 ], [ 2 ], ... [ 9 ] - standard number keys;

[ 00 ] - key input 2 zeros;

[ → ] - remove the last character on the display;

[ +/- ] - change the mathematical sign of;

[ XY ] - calculation of X to the power of Y;

[ √ ] - calculate the square root;

[ + ] - addition, [ - ] - subtraction, [ х ] - multiplication, [ ÷ ] - division;

[ % ] - calculates percentages;

[ M+ ] - stored in the memory with the sign [ + ];

[ M- ] - stored in the memory with the sign [ - ];

[ MR ] - get the contents of memory;

[ MC ] - erases the memory content;

[ AC ] - reset the calculator and reset the memory;

[ C ] - resets the calculator without resetting the memory.

Examples of calculations on the online calculator

Calculate the square root of 529: 529 [ √ ]. The result is equal to 23.

Raise the number 3 to a power 4: 3 [ XY ] 4 [ = ]. The result is equal to 81.

Calculation of percentage of the number of: 500 [ х ] 25 [ % ]. The result is equal to 125.

Calculating what percent is one number of another number: 25 [ ÷ ] 500 [ % ]. The result is equal to 5(%).

Adding percentage to the number: 500 [ + ] 25 [ % ]. The result is equal to 625.

Deduction percentage of the number: 500 [ - ] 25 [ % ]. The result is equal to 375.

Enter commands from the keyboard PC/Mac

To use free online calculator you can use both ordinary numeric buttons at the top of a keyboard and numeric buttons on the right of a keyboard.

To enter [ = ] - key [Enter].

To erase the last character - [Backspace] (arrow keys).

To enter [ + ] - key [ + ] at the top or [ + ] key on the numeric keypad on the right.

To enter [ - ] - key [ - ] at the top or [ - ] key on the right.

To enter [ x ] (multiplication) - key [ * ] on the numeric keypad on the right or a combination of keys[ * ] and [ Shift ].

To enter [ ÷ ] (divide) - key [ / ] on the numeric keypad on the right or a combination of keys [ : ] and [ Shift ].

Frequently asked questions about the calculator

Why do we get 8 when trying to calculate 2+2x2 with a calculator?

Calculator performs mathematical operations in accordance with the order they are entered. You can see the current math calculations in a smaller display that is below the main display of the calculator.

Calculations order for this given example is the following: 2+2=4, subtotal - 4. Then 4x2=8, the answer is 8.

The History of calculators

The ancestor of the modern calculator is Abacus, which means 'board' in Latin. Abacus was a grooved board with movable counting labels (stones or bones).

Presumably, the first Abacus appeared in ancient Babylon about 3 thousand years BC. In Ancient Greece, abacus appeared in the 5th century BC.

A loan is a contract between a borrower and a lender in which the borrower receives an amount of money (principal) that they are obligated to pay back in the future. Most loans can be categorized into one of three categories:

Amortized Loan: Paying Back a Fixed Amount Periodically

Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans, or click the links for more detail on each.

Results:

|

Deferred Payment Loan: Paying Back a Lump Sum Due at Maturity

Results:

|

Mortgage Calculator

Bond: Paying Back a Predetermined Amount Due at Loan Maturity

Use this calculator to compute the initial value of a bond/loan based on a predetermined face value to be paid back at bond/loan maturity.

Results:

|

Amortized Loan: Fixed Amount Paid Periodically

Many consumer loans fall into this category of loans that have regular payments that are amortized uniformly over their lifetime. Routine payments are made on principal and interest until the loan reaches maturity (is entirely paid off). Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. In everyday conversation, the word 'loan' will probably refer to this type, not the type in the second or third calculation. Below are links to calculators related to loans that fall under this category, which can provide more information or allow specific calculations involving each type of loan. Instead of using this Loan Calculator, it may be more useful to use any of the following for each specific need:

| Mortgage Calculator | Auto Loan Calculator |

| Student Loan Calculator | FHA Loan Calculator |

| VA Mortgage Calculator | Investment Calculator |

| Business Loan Calculator | Personal Loan Calculator |

Deferred Payment Loan: Single Lump Sum Due at Loan Maturity

Many commercial loans or short-term loans are in this category. Unlike the first calculation which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity.

Bond: Predetermined Lump Sum Paid at Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer (borrower) when the bond matures, assuming the borrower doesn't default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond's value at maturity, a bond's market price can still vary during its lifetime.

Loan Basics for Borrowers

Interest Rate

Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which include both interest and fees. The rate usually published by banks for saving accounts, money market accounts, and CDs is the annual percentage yield, or APY. It is important to understand the difference between APR and APY. Borrowers seeking loans can calculate the actual interest paid to lenders based on their advertised rates by using the Interest Calculator. For more information about or to do calculations involving APR, please visit the APR Calculator.

Compounding Frequency

Compound interest is interest that is earned not only on initial principal, but also on accumulated interest from previous periods. Generally, the more frequently compounding occurs, the higher the total amount due on the loan. In most loans, compounding occurs monthly. Use the Compound Interest Calculator to learn more about or do calculations involving compound interest.

Http://calculator.net

Loan Term

A loan term is the duration of the loan, given that required minimum payments are made each month. The term of the loan can affect the structure of the loan in many ways. Generally, the longer the term, the more interest will be accrued over time, raising the total cost of the loan for borrowers, but reducing the periodic payments.

Consumer Loans

There are two basic kinds of consumer loans: secured or unsecured.

Secured Loans

A secured loan means that the borrower has put up some form of asset as a form of collateral before being granted a loan. The lender is issued a lien, which is a right to possession of property belonging to another person until a debt is paid. In other words, defaulting on a secured loan will give the loan issuer legal ability to seize the asset that was put up as collateral. The most common secured loans are mortgages and auto loans. In these examples, the lender holds the deed or title, which is a representation of ownership, until the secured loan is fully paid. Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car.

Lenders are generally hesitant to lend large amounts of money with no guarantee. Secured loans reduce the risk of the borrower defaulting, since they risk losing whatever asset they put up as collateral. If the collateral is worth less than the outstanding debt, the borrower can still be liable for the remainder of the debt.

Secured loans generally have a higher chance of approval compared to unsecured loans and can be a better option for those who would not qualify for an unsecured loan,

Unsecured Loans

An unsecured loan is an agreement to pay a loan back without collateral. Because there is no collateral involved, lenders need a way to verify the financial integrity of their borrowers. This can be achieved through the five C's of credit, which is a common methodology used by lenders to gauge the creditworthiness of potential borrowers.

- Character—may include credit history and reports to showcase the track record of a borrower's ability to fulfill debt obligations in the past, their work experience and income level, and any outstanding legal considerations

- Capacity—measures a borrower's ability to repay a loan using a ratio to compare their debt to income

- Capital—refers to any other assets borrowers may have, aside from income, that can be used to fulfill a debt obligation, such as a down payment, savings, or investments

- Collateral—only applies to secured loans. Collateral refers to something pledged as security for repayment of a loan in the event that the borrower defaults

- Conditions—the current state of the lending climate, trends in the industry, and what the loan will be used for

Unsecured loans generally feature higher interest rates, lower borrowing limits, and shorter repayment terms than secured loans. Lenders may sometimes require a co-signer (a person who agrees to pay a borrower's debt if they default) for unsecured loans if the lender deems the borrower as risky.

If borrowers do not repay unsecured loans, lenders may hire a collection agency. Collection agencies are companies that recover funds for past due payments or accounts in default.

Examples of unsecured loans include credit cards, personal loans, and student loans. Please visit our Credit Card Calculator, Personal Loan Calculator, or Student Loan Calculator for more information or to do calculations involving each of them.